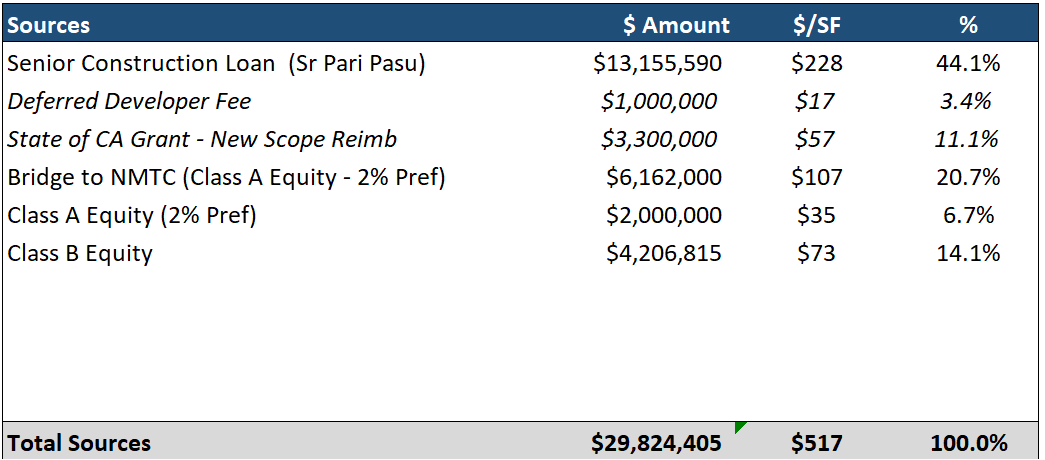

LOAN REQUEST: $13,155,590

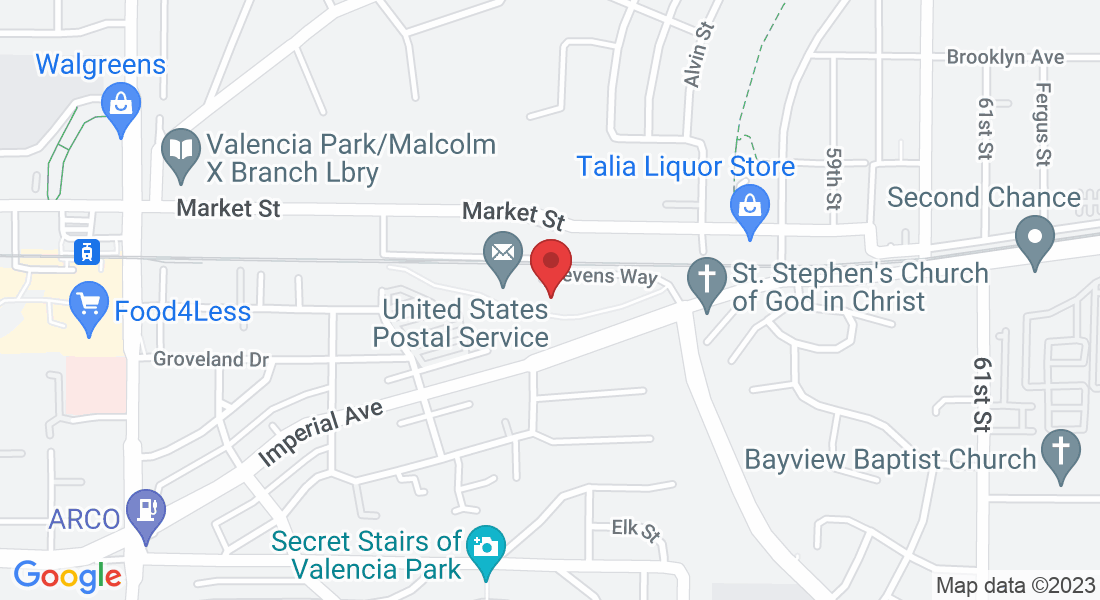

San Diego, CA

Executive Summary

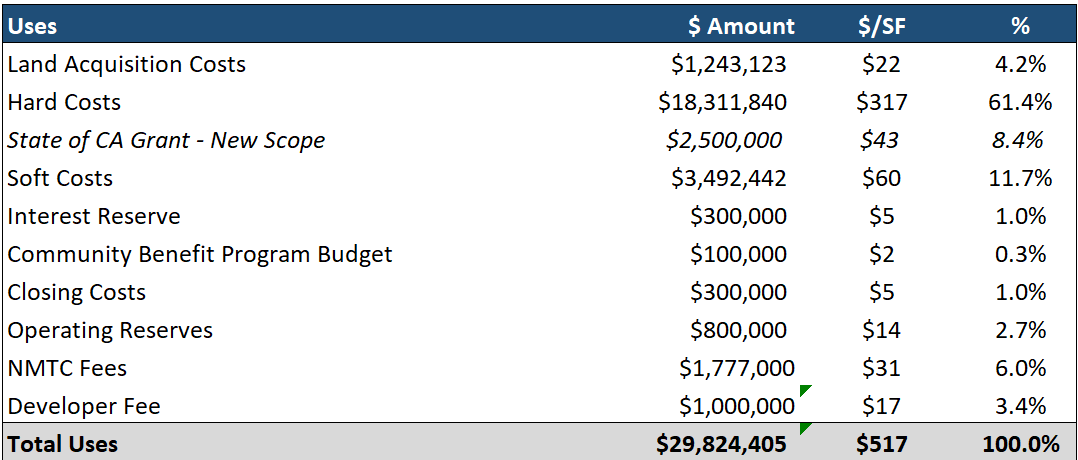

SDEEC, LLC (The “Sponsor”) has engaged Divergent Holdings on an exclusive basis to source $13.15M in development financing for The San Diego Energy Equity Campus (“SDEEC”), a 57,737 square foot campus located in the Valencia Park sub-market of San Diego, CA, consisting of a multi-tenant 2 story flex office building and one story flex building. The property will be one of the first of its kind in creating a synergistic campus focused on leasing to tenants who are active in the sustainable energy space. SDEEC is currently 82% pre-leased and has secured both city grants and New Market Tax Credits lowering the overall Debt and Equity requirement providing a lower risk to the lender.

(The "Sponsor") has designed this project as a environmentally all green development. Their goal is to leave no carbon footprint post development, with 82.5% pre-leased to environmentally focused tenants.

57,737

Square Feet

2023

Build Year

$228

Loan Per Square Foot

48.72%

Estimated LTV

10.0%

Stabilized Debt Yield

1.26x

Stabilized DSCR

Credit Highlights

Substantial Pre-Leasing - the sponsors have secure leases for 82% of the available space with lease terms ranging from 6 - 10yrs

Strong Loan Economics - 44% Loan to Cost, 10% Stabilized DY.

Stable Market - Positive absorption and sub 5% market vacancy with strong demands for flex industrial space

Seasoned Sponsorship - Over 100 years combined experience spread across $1B in transaction volume.

Get Financial Details Here

Market Summary

The Valencia Park area of San Diego is a strong market for flex industrial commercial development due to its strategic location and access to major transportation corridors. The flex industrial market in Valencia Park is currently performing well, with low vacancy rates and rising rental rates.

According to recent data from CBRE, the vacancy rate for flex industrial space in the Valencia Park area is currently around 5%, which is lower than the national average. Rental rates for flex industrial space in Valencia Park have been steadily increasing over the past few years and are expected to continue to rise in the coming years.

The demand for flex industrial space in Valencia Park is driven by a number of factors, including the area's proximity to major transportation corridors, such as Interstates 5 and 805, and the presence of major employers in industries such as defense, biotech, and technology. The absorption rate for flex industrial space in Valencia Park is currently around 300,000 square feet per year, which indicates a strong demand for this type of space.

Contact

(916) 507-1042

This Confidential Financing Memorandum (the “Memorandum”) has been prepared and presented to the recipient (the “Recipient”) by Divergent Holdings (“Divergent”) as part of Divergent’s efforts to source financing for the real Property referenced herein (the “Property”). Divergent is the exclusive agent and broker for the owner(s) or buyer (s) of the Property (the “Borrower”). Divergent is providing this Memorandum and the material in it to the Recipient with the understanding that the Recipient will independently investigate those matters that it deems necessary and appropriate to evaluate the Property and that the Recipient will rely only on its own investigation, and not on Divergent, the Borrower or this Memorandum, in determining whether to finance the Property. The materials contained in this Memorandum and any other materials and/or information provided about the Property and/or Borrower are to be kept strictly confidential and to be used only to evaluate Recipient’s interest in financing the Property. PLEASE NOTE THE FOLLOWING: Divergent, the Borrower and their respective agents, employees, representatives, property managers, officers, directors, shareholders, members, managers, partners, joint venturers, corporate parents or controlling entities, subsidiaries, affiliates, assigns and predecessors and successors-in interest make no representations or warranties about the accuracy, correctness or completeness of the information contained in this Memorandum. The Recipient is urged not to rely on the information contained in this Memorandum and to make an independent investigation of all matters relating to the Property. This Memorandum includes statements and estimates provided by or to Divergent and/or the Borrower regarding the Property. Those statements and estimates may or may not be accurate, correct or complete. Nothing contained in this Memorandum should be construed as a representation or warranty about the accuracy, correctness or completeness of such statements and estimates. Further, nothing contained in this Memorandum should be construed as representation or warranty about any aspect of the Property, including, without limitation, the Property’s (1) past, current or future performance, income, uses or occupancy, (2) past, current or prospective tenants, (3) physical condition, (4) compliance or non-compliance with any permit, license, law, regulation, rule, guideline or ordinance, or (5) appropriateness for any particular purpose, investment, use or occupancy. Again, the Recipient is urged not to rely on this Memorandum and the statements and estimates in it and to make an independent investigation regarding the Property and the statements and estimates contained herein. This Memorandum may include statements regarding, references to, or summaries of, the nature, scope or content of contracts and/or other documents relating to the Property. Those statements, references or summaries may or may not be accurate, correct, or complete. Additionally, Divergent may not have referenced or included summaries of each and every contract and/or other document that the Recipient might determine is relevant to its evaluation of the Property. Nothing contained in this Memorandum should be construed as a representation or warranty about the accuracy, correctness or completeness of such statements, representations or summaries. On request and as available, and subject to the Borrower’s consent, Divergent will provide the Recipient with copies of all referenced contracts and other documents. Divergent assumes no obligation to supplement or modify the information contained in this Memorandum to reflect events or conditions occurring on or after the date of the preparation of this Memorandum. More detailed information regarding the anticipated terms, conditions and timing of any offering by the Borrower relating to the Property will be provided in due course by separate communication. Divergent and/or the Borrower reserve the right to engage at any time in discussions or negotiations with one or more recipients of this Memorandum and/or other prospective financing sources of the Property without notice or other obligation to the Recipient.